Doses of Hope: Expanding Vaccine Access for Honduran Families

Immunizations are a cornerstone of global health, contributing to millions of lives saved. Widespread vaccination helps control the spread of…

Learn More

Protecting Children in Emergencies: Perspectives from Syria and Ukraine

By Emily Galloway, Tarek Fakhereddin, Nataliia Biloshytska and Tania Dudnyk Global Communities has a rich history of providing emergency aid…

Learn More

Adapting and Innovating in a Volatile World: Reflections from the 2024 Fragility Forum

By Paula Rudnicka, Sr. Manager for Public Affairs Last month, the World Bank held its 2024 Fragility Forum – a…

Learn More

Strengthening Economic Opportunities for Women Entrepreneurs through Cooperatives

By Ashley Holst Cooperatives are leaders in promoting inclusive economic growth by providing equitable and accessible solutions to economic and…

Learn More

‘Game-Changing’ Water System Introduced in Northern Ghana

In the heart of the Bole District in Northern Ghana lies the serene and welcoming Mandari Community, a place that…

Learn More

Unlocking Economic Empowerment: Insights from Gender Analyses in Guatemala and Kenya

By Chloe Pan Globally, nearly 2.4 billion women do not have the same economic rights as men, and on average,…

Learn More

Promoting Economic Advancement as a Pathway to Preventing HIV and Violence against Adolescent Girls and Young Women

By Betty Adera This month, as we observe International Women’s Day 2024, it is imperative to reflect on the multifaceted…

Learn More

Bridging Healthcare Gaps for Island Communities in Ghana

In a momentous step towards revolutionizing healthcare accessibility for secluded island communities in the Oti region of Ghana, the United…

Learn More

Global Communities and Bank of Palestine Scale Up Support for Families in Gaza with Essential WASH Units

Gaza Strip — In the spirit of sustained cooperation and a shared commitment to supporting those displaced by war in…

Learn More

Guatemalan School Kitchens Reopen After COVID-19 Shutdown

By Chloe Pan For the first time in nearly four years, school meals are once again being prepared in Guatemalan…

Learn More

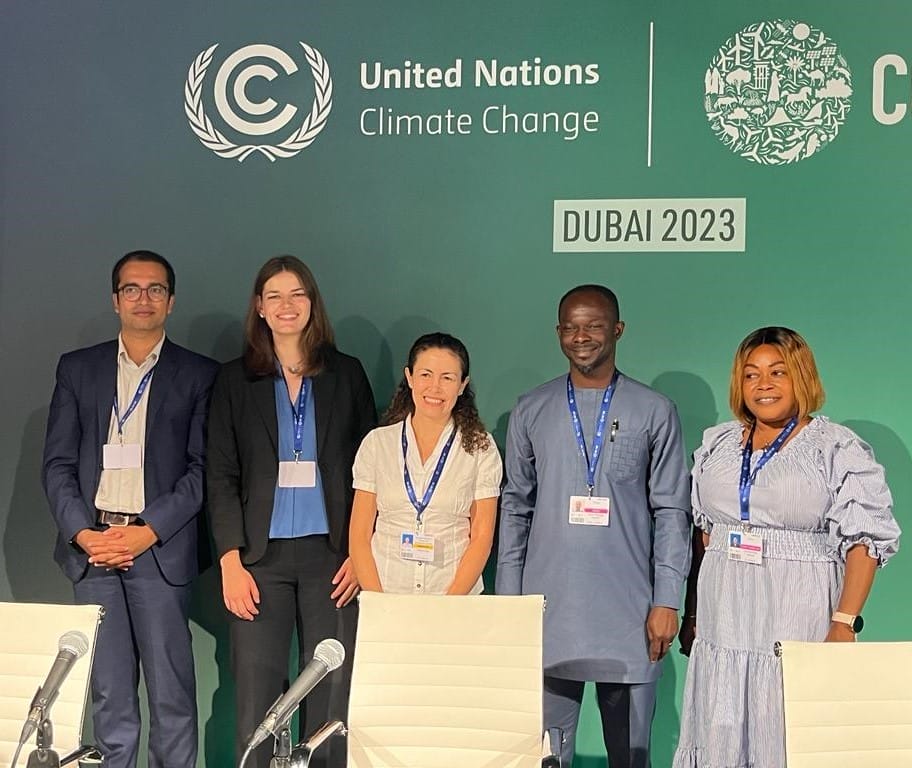

How to Develop Climate & Disaster Risk Finance Strategies: Reflections from the COP28

By Patricia Inga Falcón & Noah Steinberg-Di Stefano At the end of last year, more than 80,000 world leaders and…

Learn More

Making Space for Economic Growth in Ukraine’s Lanovetska Community

For years, Lanovetska Territorial Community, located in Ternopil oblast of Ukraine, was off the global economic map. Aspiring entrepreneurs were…

Learn More

Driving Change: Youth-Led Worker Cooperative Transforming Kenya’s Automotive Industry

By Tindi Sitati and Mike Kipngeno Rooted in the energy of youth, the Transparency Auto Worker Cooperative was created in…

Learn More

‘Survival, Resilience and Solidarity’: Our Relief Efforts in Gaza

By Maureen Simpson Now over four months in, the humanitarian crisis in Gaza has reached catastrophic levels, with one in…

Learn More